Dasiwang: Your Gateway to Trending Insights

Stay updated with the latest news, trends, and insights across various topics.

Offshore Banking: The Secret Playground for Your Money

Discover how offshore banking can be your secret weapon for wealth growth and financial freedom. Unlock hidden benefits now!

What is Offshore Banking and How Does It Work?

Offshore banking refers to opening a bank account or establishing a financial relationship with a bank located outside of one's home country. These banks typically provide a range of services, including savings accounts, investment options, and credit facilities, often under more favorable banking terms than domestic institutions. The key reasons individuals and businesses choose to open offshore accounts are privacy, asset protection, and tax optimization. Offshore banks are often located in jurisdictions that have stringent banking secrecy laws and favorable tax regulations, making them attractive for wealth management and financial planning.

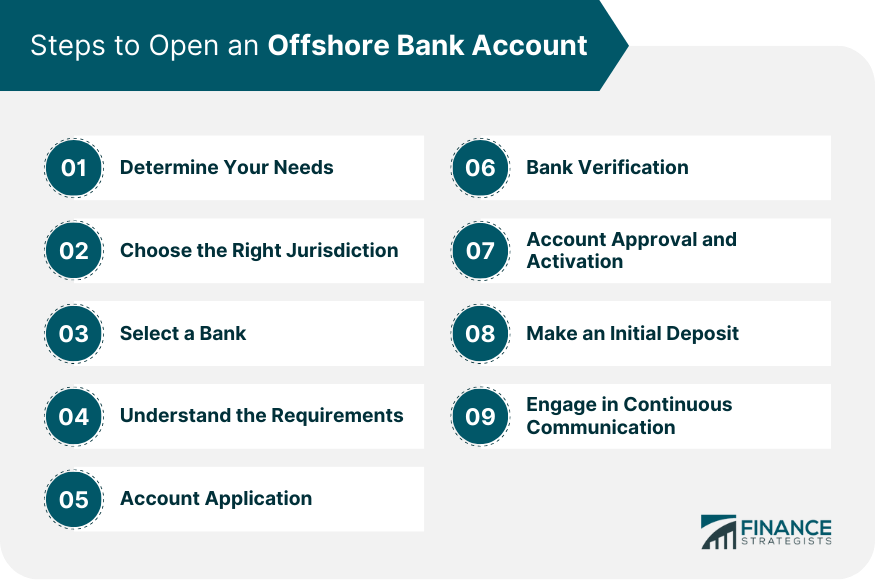

To open an offshore account, one typically needs to provide identification, proof of address, and sometimes a reference from their home bank. Each offshore bank may have different requirements and minimum deposit amounts, which can vary significantly. Once the account is established, customers can manage their finances internationally, transfer funds, and make investments through a secure online banking platform. It is important for account holders to understand the laws governing offshore banking, including tax reporting requirements in their home country, to ensure they remain compliant while enjoying the benefits of their offshore banking arrangements.

Top 5 Benefits of Using Offshore Banks for Wealth Management

Offshore banks offer numerous advantages for individuals looking to enhance their wealth management strategies. One primary benefit is asset protection. By placing funds in an offshore account, clients can safeguard their wealth from political instability, economic downturns, and legal disputes in their home country. This added layer of security allows investors to have peace of mind knowing their assets are well-protected.

Another significant advantage is tax optimization. Many offshore jurisdictions provide favorable tax environments, which can help individuals reduce their overall tax liabilities. This legal approach to tax planning enables investors to maximize their returns and preserve more of their wealth. Furthermore, offshore banks often offer tailored financial products and services, ensuring clients receive personalized support in achieving their wealth management goals.

Is Offshore Banking Right for You? Debunking Common Myths

Offshore banking has long been surrounded by a cloud of misconceptions that can deter individuals and businesses from exploring its benefits. One common myth is that offshore banking is solely for the wealthy or those looking to hide assets. In reality, offshore accounts can be accessible to a broader range of clients, including those seeking to diversify their investments or protect their savings from economic instability. By understanding the true nature of offshore banking, potential clients can make informed decisions about their financial futures.

Another prevalent myth is that offshore banks are unregulated and operate outside the law. This notion is misleading, as many reputable offshore banks adhere to strict regulations set by their home countries. Furthermore, these institutions often offer enhanced privacy features that are designed to keep your financial information secure. It’s essential to do your research and find a bank that complies with both local and international laws, ensuring your money is safe and sound. By debunking these common myths, individuals can better assess whether offshore banking aligns with their financial goals.