Dasiwang: Your Gateway to Trending Insights

Stay updated with the latest news, trends, and insights across various topics.

Unlocking Hidden Savings: Discovering Auto Insurance Discounts You Didn't Know Existed

Uncover secret auto insurance discounts and save big! Discover hidden savings you never knew existed today!

Top 10 Auto Insurance Discounts You Might Be Missing Out On

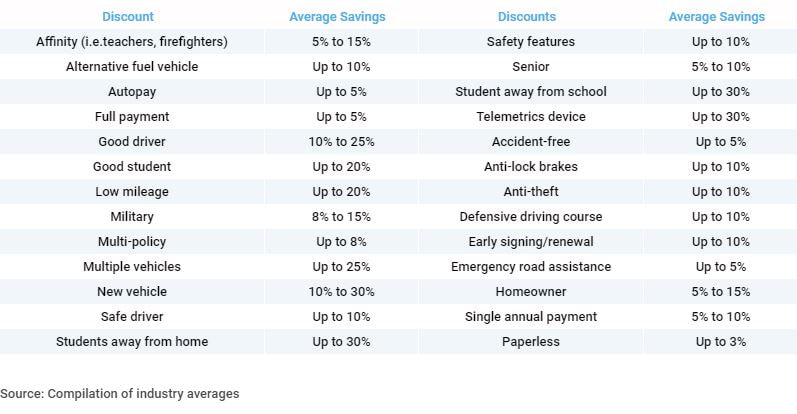

When it comes to saving money on your car insurance, many drivers are unaware of the various discounts available that can significantly reduce their premiums. Here are the top 10 auto insurance discounts you might be missing out on:

- Safe Driver Discount - If you maintain a clean driving record without any accidents or traffic violations, you may qualify for a safe driver discount.

- Multi-Policy Discount - Bundling your auto insurance with other policies, like home or renters insurance, can lead to considerable savings.

- Good Student Discount - Students maintaining a certain GPA may qualify for discounts, helping young drivers save on insurance costs.

- Low Mileage Discount - If you drive less than average miles per year, many insurers will reward you with a lower premium.

- Military Discount - Active duty military personnel and veterans may receive special discounts from several insurers.

In addition to the discounts listed above, consider exploring the following options for even more savings:

- New Car Discount - If you own a newer model vehicle, insurers often provide discounts due to enhanced safety features.

- Payment Options Discount - Some companies offer discounts if you pay your premium in full rather than in installments.

- Loyalty Discount - Staying with the same insurer for multiple years can lead to customer loyalty discounts.

- Professional Association Discounts - Members of certain professional organizations may qualify for exclusive auto insurance discounts.

- Telematics Discount - Enrolling in a telematics program that monitors your driving habits can result in potential savings based on good driving behavior.

How to Maximize Your Savings: A Guide to Lesser-Known Auto Insurance Discounts

When it comes to maximizing your savings on auto insurance, many people overlook the potential of lesser-known discounts. One valuable approach is to inquire about multi-policy discounts, where bundling your auto insurance with other types of coverage—such as homeowners or renters insurance—can lead to significant savings. Additionally, many insurers offer discounts for drivers who maintain a clean driving record. It's also wise to ask about low-mileage discounts if you don't drive frequently, as insurers may provide a break for those who are on the road less often.

Furthermore, don't forget to explore discounts related to safety and technology features in your vehicle. Many insurance providers reward vehicles equipped with advanced safety systems, like anti-lock brakes or stability control. Another often-overlooked opportunity is the good student discount, which can significantly benefit younger drivers who maintain a high GPA. Take the time to thoroughly research and discuss these options with your insurance agent to ensure you're leveraging all possible auto insurance discounts available to you.

Are You Eligible? Discover Hidden Discounts for Your Auto Insurance Policy

Are you aware that you might be eligible for hidden discounts on your auto insurance policy? Many drivers underestimate the potential savings they can access by simply asking their insurance provider about various discounts available. Some common discounts include multicar discounts for insuring more than one vehicle, good driver discounts for those with a clean driving record, and even student discounts for young drivers maintaining good grades. To dive deeper into the types of discounts available, visit NAIC's comprehensive guide.

In addition to the typical discounts, many insurers offer specialized discounts that may not be widely advertised. For example, those who complete a defensive driving course or install safety features in their vehicles can often earn additional savings. It's worth reaching out to your insurance agent and inquiring about any potential hidden opportunities for you. Remember, taking proactive steps to explore these options can lead to significant savings on your auto insurance policy. For more insightful tips on maximizing your auto insurance savings, check out Consumer Reports.