Dasiwang: Your Gateway to Trending Insights

Stay updated with the latest news, trends, and insights across various topics.

Term Life Insurance: The Safety Net You Didn't Know You Needed

Discover the unexpected benefits of term life insurance – the essential safety net that could protect your loved ones when they need it most!

Understanding Term Life Insurance: How It Protects Your Loved Ones

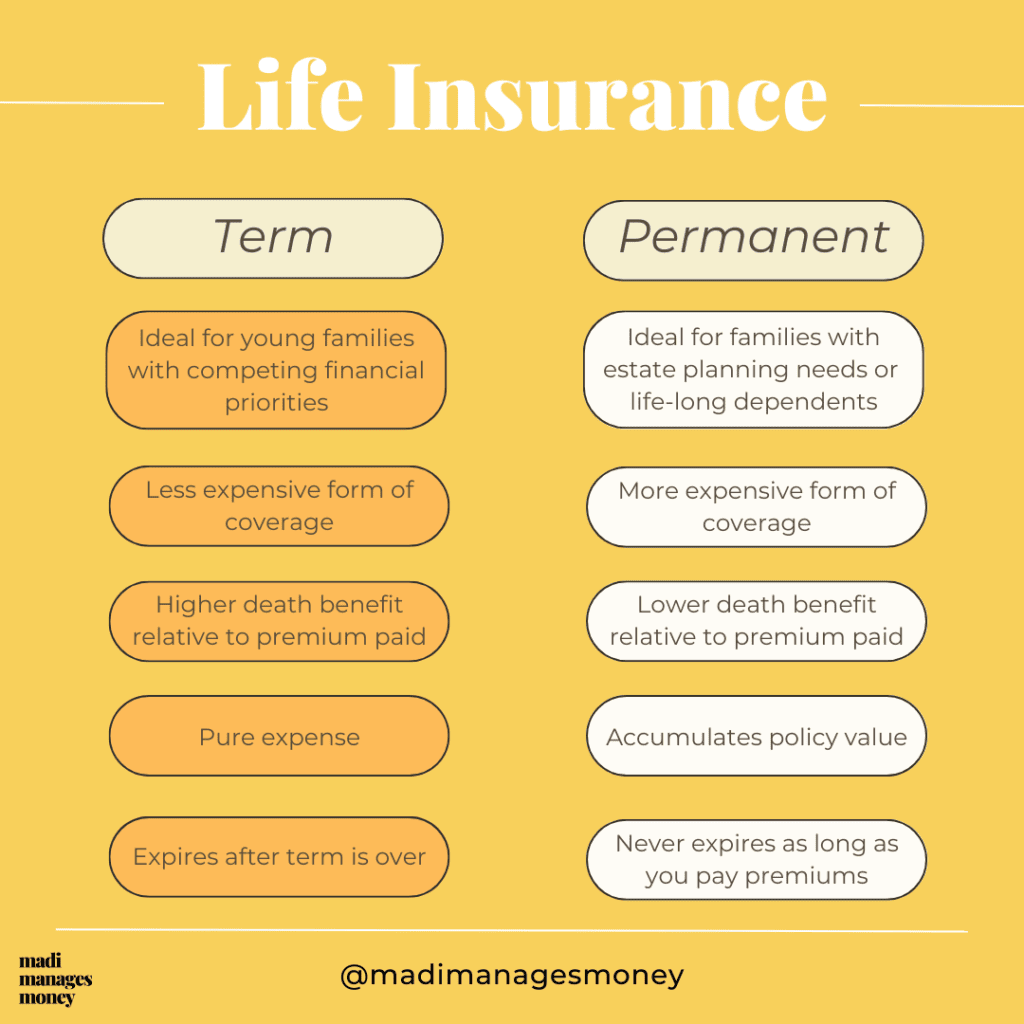

Term life insurance is a type of life insurance that offers coverage for a specified period, typically ranging from 10 to 30 years. This form of insurance is designed to provide financial support for your loved ones in the event of your untimely passing. Unlike permanent life insurance, which builds cash value over time and provides lifelong coverage, term life insurance is usually more affordable and straightforward. It ensures that your beneficiaries receive a death benefit that can help cover expenses such as mortgage payments, education costs, and daily living expenses, thereby securing their financial future.

Understanding how term life insurance protects your loved ones is essential for making informed financial decisions. If you pass away within the term of your policy, your beneficiaries will receive a lump-sum payment, which can be crucial in maintaining their standard of living. Many individuals consider factors like their current debt, future financial obligations, and the needs of their dependents when choosing the appropriate amount of coverage. Additionally, it's important to periodically review and adjust your policy to reflect life changes, ensuring that your family's financial protection remains adequate throughout the years.

Top 5 Misconceptions About Term Life Insurance Debunked

Term life insurance is often misunderstood, leading to several misconceptions that can deter individuals from obtaining the coverage they need. One common myth is that term life insurance doesn't provide any value if the policyholder outlives the term. However, it's important to recognize that the primary purpose of term life insurance is to provide financial protection to beneficiaries in the event of the policyholder's death during the policy term. The peace of mind that comes with knowing your loved ones will be financially secure is invaluable, regardless of whether a claim is ever made.

Another prominent misconception is that term life insurance is always expensive. In reality, term life insurance can be quite affordable, especially for younger and healthier individuals. The premiums are often lower than those of whole life policies, making it an accessible option for many families. Additionally, many insurers offer flexible terms and coverage amounts, allowing customers to tailor the policy to fit their budgets and specific needs. By debunking these myths, consumers can make more informed decisions regarding their life insurance options.

Is Term Life Insurance Right for You? Key Factors to Consider

When considering term life insurance, it’s essential to evaluate your personal circumstances and financial goals. One key factor is your current life stage. For instance, if you are in a critical period of life—such as starting a family, buying a home, or paying off student loans—having a term life insurance policy can provide peace of mind that your financial obligations will be met in case of the unexpected. Additionally, consider your future financial responsibilities, such as children’s education and retirement planning, to determine the appropriate coverage.

Another important aspect to think about is the duration of coverage you need. Term life insurance offers policies that typically range from 10 to 30 years, allowing you to select a term that aligns with your projected financial commitments. It's also wise to analyze your budget to ensure that the premiums fit comfortably within your monthly expenses. Consulting with a financial advisor can further help you assess whether a term policy will fulfill your needs and how it compares to other insurance options, such as whole life insurance.