Dasiwang: Your Gateway to Trending Insights

Stay updated with the latest news, trends, and insights across various topics.

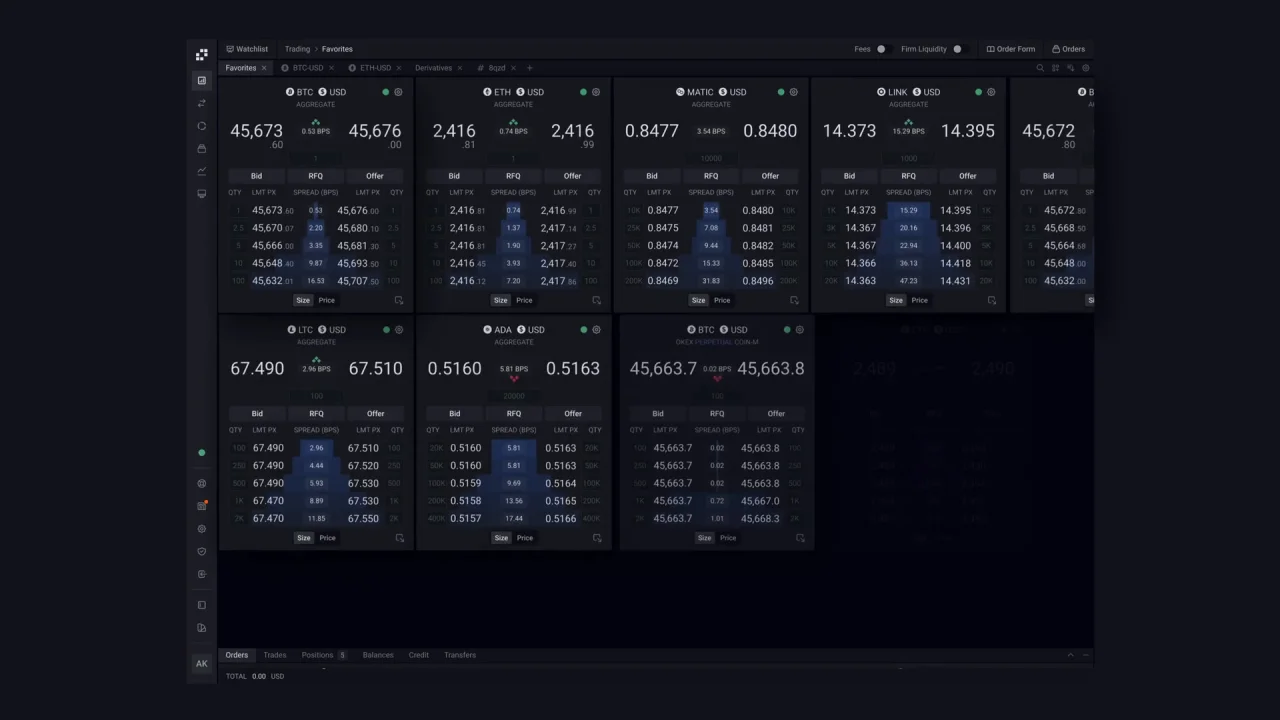

Digital Asset Trading: A Treasure Hunt in the Virtual Marketplace

Uncover the secrets of digital asset trading! Dive into the virtual marketplace and turn your investments into treasure. Join the hunt now!

Understanding the Basics of Digital Assets: A Beginner's Guide to Virtual Trading

Digital assets have revolutionized the way we think about ownership and value in the modern world. In essence, digital assets are anything that exists in a digital format and comes with ownership rights. This includes cryptocurrencies like Bitcoin and Ethereum, as well as digital art, music, videos, and even domain names. Understanding these assets is essential for anyone interested in virtual trading, as it allows you to navigate this emerging landscape and make informed decisions. The basics of digital assets encompass key concepts such as blockchain technology, the significance of decentralization, and the various types of assets available for trading.

For beginners, starting with virtual trading may seem daunting, but breaking it down into manageable steps can simplify the process. First, educate yourself on the different types of digital assets available for trading:

- Cryptocurrencies: Digital currencies that use cryptography for security.

- Non-Fungible Tokens (NFTs): Unique digital tokens representing ownership of a specific item.

- Digital Goods: Items created and sold online, such as eBooks or music.

Counter-Strike is a widely popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can enhance their gaming experience by utilizing various resources, including in-game purchases and skins. For those looking to save some money, consider using a daddyskins promo code to get discounts on your favorite items.

Top 10 Strategies for Success in the Digital Asset Marketplace

As the digital asset marketplace continues to grow, understanding the strategies that lead to success has never been more crucial. Here are the top 10 strategies that can help you navigate this dynamic environment effectively:

- Research Thoroughly: Before entering the digital asset marketplace, it’s essential to conduct thorough research on the assets you wish to invest in. Understanding market trends and asset performance can lead to informed decisions.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. By diversifying your investments across various digital assets, you can mitigate risks and enhance potential returns.

Moreover, employing sound strategies can maximize your success. Regularly monitor the performance of your digital assets and adjust your strategies accordingly. Here are more strategies:

- Engage with the Community: Building relationships with other investors and experts can provide valuable insights and foster opportunities for collaboration.

- Stay Informed: The digital asset landscape is constantly evolving. Keeping up with the latest news and trends allows you to adapt your strategies.

What Risks Should You Be Aware of When Trading Digital Assets?

When considering the risks associated with trading digital assets, it is essential to understand the volatility inherent in this market. Prices can fluctuate dramatically within short time frames, leading to significant profit opportunities but also to the potential for devastating losses. Traders should be aware of market manipulation, where large holders, often referred to as 'whales,' can influence asset prices by making large trades. Furthermore, it's important to conduct thorough research to avoid pitfalls associated with less reputable exchanges or coins that may lack liquidity.

An equally critical risk to consider is the security of your investments. Unlike traditional banking systems, the digital asset space is often targeted by hackers and cybercriminals. Investors should take proactive measures by utilizing hardware wallets for storage and enabling two-factor authentication on their accounts. Additionally, be wary of phishing scams that can compromise your private keys. By understanding these various risks, traders can make informed choices and protect their investments more effectively.